Attention Apprentice Employers

Right now, it couldn’t be a better time to employ or take up an apprenticeship.

By Phillip Mortimer and Davin Tranter

A major focus of the 2022 Federal Budget has been on the skills and training available for Australia’s employees and apprentices. The good news is that there are a wide range of initiatives that will provide financial support for both employers and employees.

About the apprentice wage subsidy

The government has invested $365.3 million towards extending the wage subsidies being granted to employers of Australian Apprentices.

In October 2020, we were introduced with the Boosting Apprenticeship Commencements (BAC) wage subsidy.

Subsequently, in September 2021 we were introduced with the Completing Apprenticeship Commencements (CAC) wage subsidy.

These incentives were designed to provide financial support to employers that have engaged new or recommencing apprentices.

The government has announced it will be extending the incentive program all the way up to June 2024.

What are the subsidies

It is important to note that the criteria and funding for the BAC and CAC subsidies will be changing. From July 2022 onwards, the new payments will be as follows:

Year 1 and 2: Employer receives a quarterly rebate for 10% of their eligible apprentice’s wages. A limit of $1500 per quarter applies.

Year 3: Employer receives a quarterly rebate for 5% of their eligible apprentice’s wages. A limit of $750 per quarter applies.

Based on the ABS definition, employers located in regional/remote Australia are entitled to an additional 5% in year 1, with a limit of $2250.

While the subsidy limit will be staying the same, the percentage of the wage that is claimed will be lower than it was previously. From July 2022, the eligibility criteria will also require the apprentice to be undertaking a certificate III or higher in a ‘priority industry’.

The term ‘priority industry’ is quite broad. It covers a wide range of occupations such as carpentry, aged-care, nursing, automotive repairs and many more. A list of what occupations are considered as part of a ‘priority industry’ can be accessed from the Australian Government’s website: Australian Apprenticeship Priority List

If an employer’s apprentice is:

Not training for an occupation within the priority list OR

Is studying for a certificate II

Then the employer will be entitled to receive two six-monthly payments of $1750, totaling to $3500.

120% Deduction on Training Expenses

The other training-based incentive announced in the Federal Budget is that businesses can claim an additional 20% tax deduction on their training expenses for employees.

The rules around this are:

The entity must be a small business with an annual aggregated turnover below $50 million.

The recipient of the training must be an employee of your business.

The training must be from an external entity (this means that in-house training and on-the-job training is excluded).

It is a little confusing for the 2022 financial year as the additional 20% cannot be claimed until the 2023 tax year. In summary, the timing of the tax deductions are as follows:

Expense incurred between 29/3/22 – 30/6/22

Claim 100% in your 2022 tax return

Claim 20% in your 2023 tax return.

Expenses incurred between 1/7/22 – 30/6/24

Claim 120% in the tax return for the year the expense was incurred.

This incentive scheme also applies for digital adoption such as portable payment devices, cyber security systems or subscriptions to cloud based services. An annual cap of $100,000 will apply for this type of expenditure.

For Australian Apprentices

But wait, there’s more. Australian apprentices undertaking a certificate III or higher and working within a ‘priority occupation’ are also entitled to direct financial support from the government. For every 6 months over the next 2 years, they will be entitled to a government payment of $1,250.

There is also a ‘Living Away from Home’ allowance available to Australian apprentices undertaking a certificate II or higher. This is applicable for those who are moving out of home for their first time, to undertake their apprenticeship studies - a support initiative that is especially pertinent to Australia’s younger generation. This loan is also available to apprentices who are living homeless.

Payments start at $77.17 per week for the first year, $38.59 per week for the second year and $25.00 per week for the third year.

Hopefully, there is something in this for your businesses and apprentices. If you want to know more about these initiatives please don’t hesitate to contact us on 9841 1200 so that we assist you to maximise these incentives.

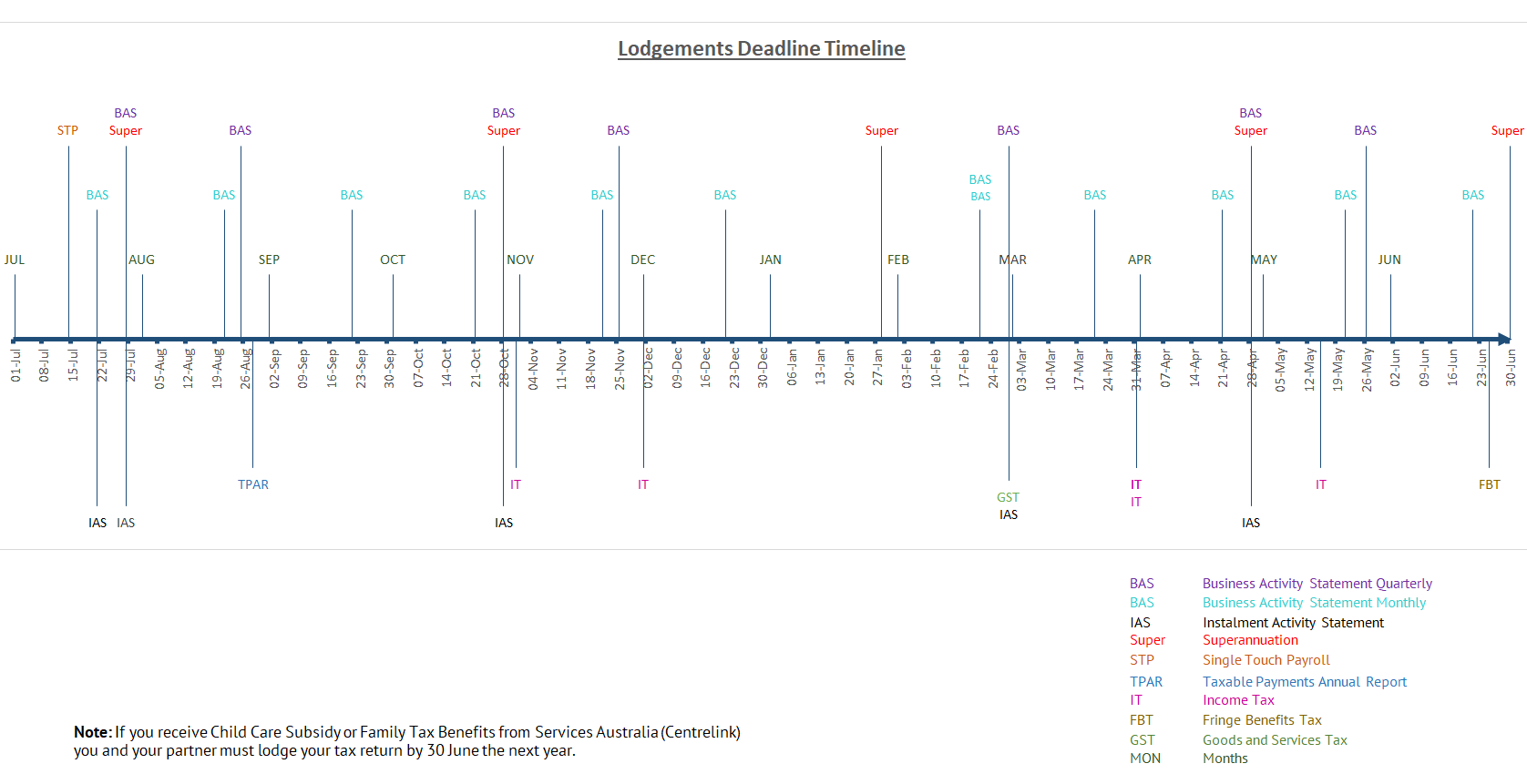

Lodgements Deadline Timeline

Download your FREE copy of our Business Lodgements Deadline Timeline. Helping you keep track of all the important dates.

Find your copy on our resources page.

MyGov Assistance is available to you.

Discover how you can get organised with MyGov by utilising the MyGov Assistance packages we have available.

If you are interested or have any questions contact us.

Note: If you do not require all of the services outlined in the packages, we are still available to assist you with the relevant parts for a reduced fee.

Episode 6 – The right business structure for you

In this episode Kym is joined by Caitlin as they navigate the different business structures available and the advantages and disadvantages of each. We also cover the new trust rules under Section 100A. Tune in and let us know what you think.