Attention High Income Earners: Division 293 Tax and why do you need to pay it?

By Senaya Cuttriss and Sarah Lowry

We can already hear the cries “What?! We are already taxed enough. Why do we have to pay more??” Unfortunately, as the old saying goes – taxes are one of the two certainties in life.

Division 293 Tax (or Div 293 for the cool kids and your Accountant) was introduced as a way to even the playing field between high and low income earners when making contributions to superannuation. Below, we shed some more light on what Div 293 tax is, when it applies and how it is calculated.

The tax rate applied to concessional superannuation contributions is 15%. Concessional contributions are contributions that are made to your superannuation fund that are pre tax deductions, e.g. compulsory superannuation guarantee contributions made by your employer or contributions you are claiming a personal tax deduction for. This flat 15% tax rate on contributions and earnings made in superannuation provides a tax concession compared to your personal tax rates, as individual income tax rates could be as high as 45%.

Div 293 tax is an additional tax on super contributions that is applied to individuals whose combined taxable income and concessional contributions exceed $250,000 in any given year. If you fall into this category, and have made concessional contributions to your superannuation will be required to pay an additional 15% tax on either the excess over the $250,000 threshold or the taxable superannuation contributions – whichever is less.

For Example:

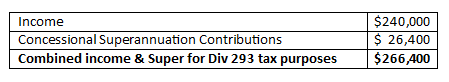

In 2023 Financial Year you have a gross salary of $240,000 and your employer makes the required 11% super guarantee contribution to your super fund.

As this individual’s combined income and concessional contributions for the 2023 financial year exceed $250,000, Div 293 tax will apply.

In this example, the amount above the $250,000 threshold ($16,400) is less than the concessional contributions for the year of $26,400, therefore the division 293 tax payable will be calculated on the excess: Div 293 tax payable is 15% of $16,400 ($2,460).

The tax office (ATO) will determine whether Div 293 tax applies once both your tax return has been lodged and your super contribution has been reported to them by your super fund. If Div 293 tax does apply, the tax office will then issue you a separate notice of assessment notifying you of your Div 293 tax obligation for the year. This can often come a lot later than your notice of assessment for your tax return.

Once you receive the notice of assessment, you will have two options for payment:

pay the tax yourself; or

elect to release money from your super fund.

If you elect for the funds to be released from your superannuation fund, you must complete an election form. If you have a MyGov account, this can be completed through it. If you do not have a MyGov account, you will be required to complete and submit a paper – “Division 293 Tax Due and Payable Election Form”, available from the ATO website.

After receiving a valid election form, the ATO will then provide your super fund with a release authority, and the super fund will then pay the amount from your super account on your behalf. There will be nothing else for you to do... unless you have a self-managed superannuation fund (SMSF) that is. If you have a SMSF, you are still required to complete and submit an election form to the ATO and you will then need to arrange payment of the Div 293 tax from the super fund account within 10 days of receiving the release authority from the ATO.

If Lincolns processes your SMSF, the ATO will send the release authority through to our Super Team. We will then contact you with new payment details for you to pay the Div 293 tax from your SMSF bank account.

Div 293 tax is a messy and complicated tax for those that have to deal with it. If you are confused or require further information please give us a call and we are happy to run through the process with you.

Need Superannuation help?

With a dedicated Superannuation division within Lincolns plus firm Partner Thomas Warner an Authorised Representative of SMSF Advisers Network, we are well equipped to assist you with your superannuation needs. Some of our services include:

Establishment and operation of self-managed superannuation funds

Fund administration

Rollovers

Advice and planning

Transition to retirement income streams

Pension funds

Contact us today.

Lincolns Community

The next chapter in our 3-part video series is here.

Our latest video showcasing the Lincolns community is now live! Head over to our Youtube channel to check them out.

Shout out to Green Man Media for making our visions come to life, we couldn't be happier with how it turned out.

Career Opportunities at Lincolns

We are looking for an IT Support Trainee.

There is a strong focus on learning and training in this role to learn all aspects of IT support. There is also an opportunity for a traineeship. Therefore, the position is ideal for people who are looking for an opportunity to start a career in IT. Find out more.

PLUS: The ‘Gap Year Student’ position for 2024 is now open. This is a fantastic opportunity for a student who would like to work for a year after completing Year 12 and before commencing studies at University or TAFE.

Applications close 30 November.