Crack the code and WIN $200 (CLOSED)

By Senaya Cuttriss and Kym Taylor

This competion is now closed… Congratulations to our winner Michelle Farrow

Want to get your hands on a $200 voucher for Monty’s Leap? (obviously).

Complete our crossword to go into the draw!

The letters in the shaded squares, reading from left to right and top to bottom will spell out our mystery phrase. Submit the winning phrase to enter the draw for a $200 voucher to Monty’s Leap.

Entries close 5pm, 30 November 2021. Winner will be notified and published in the December newsletter.

Screenshot and complete the below or download a print version here.

Stapled super funds – new from 1 November 2021

An employee’s superannuation fund is now linked to them and follows them as they change jobs. This is known as a “stapled super fund”.

What does this mean for employers?

From 1 November, if your employee does not return the super choice form (remember this needs to be given to eligible employees within 28 days of commencing employment), there are now additional steps you’ll need to take.

Instead of paying to your default fund, you now need to ask the ATO to identify if that employee has an existing super fund that can be used to receive the Super Guarantee payment.

Here’s what you need to do

Make sure you’ve submitted a TFN declaration or STP pay event for the employee (this creates a link in the ATO’s systems which then allows the ATO to disclose information about that employee to you)

Make sure you have the employee’s details (TFN if you have it, full name, date of birth, residential or postal address)

Log onto ATO Online services

Go to Employees > Employee super accounts

Click Request and enter the employee’s details

A results screen will be returned and the employee will be notified that you’ve made the request

Why was this change introduced?

This change is part of the federal government’s super reform package called “your future your super” and became effective from 1 November 2021.

The intention of this change is to benefit the employee. The key benefit is that it will prevent the creation of multiple super accounts, therefore reducing account fees employees pay on their super.

Need help?

Your accountant is able to make this request on your behalf. Speak with your accountant if you need assistance.

Director ID Regime

Australia’s Director Identification Number (DIN) regime came into effect on 1 November 2021. If you are a director of an Australian company, you will be required you to register for an identification number.

A DIN is a 15 digit identifier that, once issued, will remain with you for life regardless of whether you stop being a director, change companies, change your name or move overseas.

The DIN is managed by the Australian Taxation Office (ATO) but created through the Australian Business Registry Services (ABRS).

Who needs a DIN?

All directors of a company, registered Australian body, registered foreign company or Aboriginal and Torres Strait Islander corporation will need a DIN. This includes directors of a corporate trustee of self-managed super funds.

Timeframes for registration

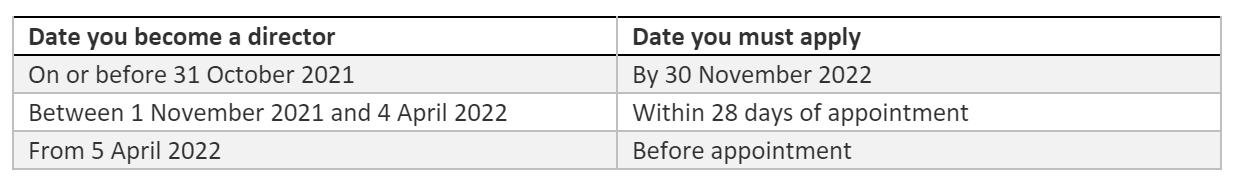

For Corporation Act directors:

If the company intends to appoint new directors, it will be important to ensure that they are aware of the requirements and timeframes to establish their DIN if they do not already have one.

Getting your DIN

To get a DIN, you will need to verify your identity and ensure that this information matches the records held by the ATO.

Verify your identity

If you establish your DIN online, and you have not already set up myGovID, you will need to download the app onto your phone or device and create an account.

The myGovID does not create your DIN - the app’s only purpose is to validate your identity, and once validated, issue a code that can be used to identify you on government online services without going through the same verification process.

myGovID uses your phone/device’s camera to scan your forms of identification such as your passport, driver’s licence and/or visa to validate who you say you are. (Be careful when you are scanning your documentation as the system does not always read the scan correctly.)Apply for your DIN through ABRS

Once you have set up your myGovID, you need to apply to the ABRS for your director ID. Use the email you used to create your myGovID to start the process.

In addition to your myGovID, you will need to have on hand documentation that matches the information held by the ATO. If you have a myGov account linked to the ATO, you can find the details on your profile (see https://my.gov.au/). You will need:

Your tax file number

The residential address held on file by the ATO; and

Two documents that verify your identity such as:

Your bank account details held by the ATO (on your myGov ATO account, see ‘my profile/financial institution details’)

Dividend statement investment reference number

Notice of assessment (NOA) – date of issue and the reference number (on your myGov ATO account, see Tax/lodgements/income tax/history)

The gross amount from your PAYG payment summary

Superannuation details including your super fund’s ABN and your member account number

The final stage requests your personal contact details (not the company’s).

Once complete, your DIN will be issued immediately on screen. This information should be provided to your company secretary or office holder.

If any of your details change, for example a change of residential address or phone number, you will need to update your details through the ABRS. You will also need to notify your company within seven days and the company will then need to notify the Australian Securities and Investments Commission (ASIC) within 28 days.

We have trained up a some of our team to be able to assist in helping you apply for a myGovID and a DIN. If you require any assistance please feel free to contact our office on 9841 1200. Please note that due to the personal information and documents required, we are not able to apply directly for you but can assist in the process.

Photo Competition Winner

WINNER

Samantha Levingston is the winner of our Photo Competition. Thank you to everyone who helped us pick the winner on Facebook and Instagram.

We had so many incredible entries. Take a look at some of our favorites.