Did you know it’s not just Accounting?

By Rochelle Black

As a new member of Lincolns and the accounting world last year, I was amazed to discover that what we do here isn’t all about the Debits and Credits.

Let’s take a step back and reflect on what I saw in my first couple of months as a graduate accountant and all the weird and wonderful things that go on here at Lincolns.

You may think that we spend the majority of our time looking at our clients’ accounting software, assisting with Business Activity Statement lodgments, tax returns and financial statement preparation. But that just isn’t the case.

In my first week, I was given a seating plan of the upstairs and downstairs offices with each of my new colleagues’ names. With 4 partners, 9 managers, 20 accountants, 7 bookkeepers, and the support team of 9, I really had no idea how handy this floor plan was going to become. Slowly I came to understand exactly what it is we do here. That’s when I realised a lot of my textbook study just wasn’t going to prepare me for the questions that arise from the vast array of clients we have .

Of course, there are the standard questions of: What can I claim in my tax return? Can I claim breakfast for myself or the workers on the way to work each day or the family pet as a security guard? What about that holiday I took while in Perth collecting supplies, or my electric bike I use to get to work each day? Can I get government support as I am stuck overseas? Why can’t I claim a donation to a charity that is not registered with the Tax Office? Which box should I tick on this Centrelink form? Whose name should my mobile phone/motor car/investment property be in?

It was very insightful for me to see how valuable a conversation can be around financing equipment and the importance of cash flow, or what not having those conversations can do to a business and its ability to function properly. I quickly realised that knowing how your money flows in and out of your business is essential to a thriving business.

Then there are the clients who are looking at starting up or buying an existing business. I discovered there are many conversations that are needed to make sure this potential investment is right for them and their family. And then there’s the amount of planning that is needed when thinking of selling a business in and what this could mean for a client’s retirement.

I have been amazed at the variety of clients we deal with at Lincolns, ranging from small to large businesses and rural clients situated all over Australia. I have already worked on a range of jobs in my time here. I’ve discovered that it involves nurturing relationships with clients, so that we are here to help from the time a person starts their working life to the time when retirement is on the doorstep.

I have only just started my career here but already feel part of the Lincolns family and cannot wait to see what else is around the corner for me. I look forward to having many more numbers running through my head, researching your questions and being here to help you in the future.

WA Government COVID-19 support for businesses

As the WA border opens up, Level 2 restrictions have been put in place to help mitigate the spread of COVID-19. The businesses to be hardest hit by these restrictions will be hospitality, food and licensed venues, nightclubs and other entertainment businesses.

To help businesses who are impacted by these restrictions, the WA Government has announced a Small Business Hardship Grants Program to provide financial support. This grants program will provide tiered grants to businesses that have a 50% or greater reduction in revenue for any two-week consecutive period between 1 January 2022 and 30 April 2022, relative to the same period in 2021, along with some other eligibility criteria. The grants include:

• $3,000 grant for sole traders (non-employing businesses)

• $7,500 grant for micro-businesses (those with one to five employees)

• $20,000 grant for small businesses (those with six to 19 employees), and

• $50,000 for medium-sized businesses (those with 20 or more employees)

But it doesn’t end there. There are other forms of assistance including Payroll Tax Waiver, Tenant Rent Relief Scheme, Landlord Rent Relief Incentive, Alfresco Support Package - all with varying eligibility criteria.

If you wish to discuss or if you need assistance to determine if you qualify for any of these support packages, please contact us on 9841 1200.

Director Identification Number

From 5 April 2022 if you want to become a director of new or existing company for the first time, you will need to have registered for a Director Identification Number (DIN) prior to your appointment.

The DIN system is new and was implemented in November of last year. It requires you to register with the Australian Business Registry Services (ABRS) and they will provide you with a DIN which is a 15-character identification number. The reason this system has been implemented is to prevent false and fraudulent director identities and for regulators to be able to trace relationships in companies over time.

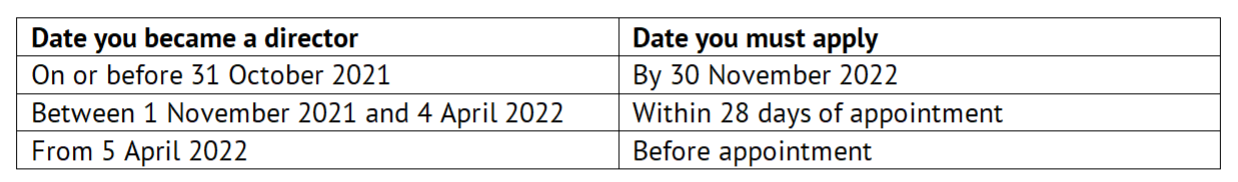

There are different timeframes for applying for a DIN depending on when you became a director:

The steps to applying are:

Set up a myGovID - How to set up | myGovID

Gather your documents:

Your Tax File Number;

Your residential address held by the ATO; and

Information from two documents to verify your identity (Examples are listed at Verify your identity | Australian Business Registry Services (ABRS))

Complete your application - ABRS - Apply for Director ID

You can also apply by phone or paper. Details on how to do this can be found here - Apply for your director ID | Australian Business Registry Services (ABRS)

We are always here to help. If you have any questions or would like assistance with your application, please call us on 9841 1200.