Believe It or Not... This Federal Budget Review Might Actually Be an Interesting Read!

By Phillip Mortimer

May 2024

Last week the Federal Treasurer, Jim Chalmers, handed down the government’s annual budget. As a viewing spectacle it’s not exactly riveting telly (trust me, I watched it) but it is very informative. Each year the government sets out its economic agenda and forecasts. We have summarised the items in this Budget which are the most relevant for our clients.

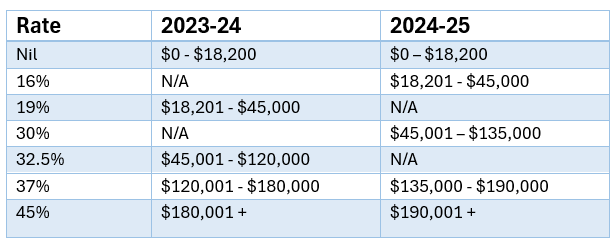

The centrepiece of the budget is the Stage 3 tax cuts, though the details of this have been known for some time. The below table shows the change to personal income tax rates from 1 July 2024.

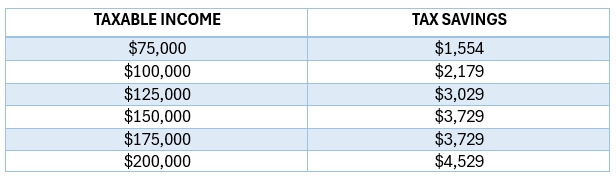

To give you an idea of how this will affect you, the table below shows the indicative tax savings that will come your way:

The term ‘Cost of Living’ came up a lot during the Treasurer’s speech. The main measure addressing this was the new energy bill relief payment. From 1 July 2024, the Budget provides rebates of $300 to every household and $325 to small businesses. The $300 rebate to households will be by way of $75 per quarter coming off your electricity bill. For us here in WA, the state government announced a week earlier that there will be a $400 electricity rebate to every household, giving us a total $700 reduction in electricity payments in the 2025 financial year.

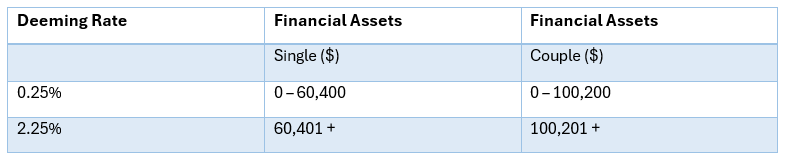

There will also be a freeze on the deeming rates Centrelink used to calculate pension and aged care payments, with the thresholds increased as shown in the table below.

These have been in place for the last two years and will continue until 30 June 2025, further assisting those receiving government support.

Other announcements in this area include:

An increase of an additional 10% in the Commonwealth Rent Assistance to those who are eligible.

Pensioners and concession card holders will pay a maximum of only $7.70 for medicines on the PBS for the next 5 years.

For the general public, prescription co-payments are frozen at $31.60 for the next 2 years.

A goal of constructing 1.2 million homes in 5 years. Building approval rates have been an issue though.

Eligibility for the higher rate of Jobseeker payments extended to single recipients who can work 0-14 hours per week.

There was some relief offered to those who currently have student debts by reducing the indexation of accumulated student contribution debts and backdating the new system to 2023. In doing so, it reversed the 2023 indexation rate from 7.1% to 3.2%. Going forward, the annual indexation rate will be the lower of the inflation rate (CPI) or the wages price index. This applies to all HELP, VET Student Loans, Australian Apprenticeship Support and other student support loans.

It also announced a new ‘Commonwealth Prac Payment’ which will provide a student payment of $319.50 a week for higher education while on clinical and professional placements.

For those planning a family, Dr Chalmers announced that from 1 July 2025 onwards superannuation will be paid on Government Funded Paid Parental Leave. From July the total amount of Paid Parental leave will increase to 22 weeks.

Small businesses with a turnover of less than $10 million will still be able to claim an instant asset write-off for plant and equipment purchases under $20,000. This will continue until 30 June 2025.

This is, in essence, how the budget will impact most of our clients. There was much in the Budget for industry assistance to large businesses involved in mining and green energy production, which may affect us at some point in the future. There was also a lot of commentary afterwards on how the Reserve Bank will see this and where interest rates are heading, which could have immediate repercussions for many of us.

If you have any questions on how this Budget concerns you personally, please don’t hesitate to contact us.

Attention Farmers… Drought Relief Grant Available Now

The WA government have now opened up applications for a $5,000 grant for farm businesses facing financial hardship due to drought conditions. This is to cover costs such as fodder, water and transportation. As we know that many of our clients have been facing these challenges we wanted to send the information through to make the process of applying as easy as possible. Eligibility for this grant is explained further in the attached guidelines but the main criteria is your annual turnover must be under $5 million and you must be able to prove hardship.

If you would like to apply click here.

Once you are on this page you then have to scroll down through the list of grants and select “Hardship Support Grant”. For the application process there is various information you will need to provide. Below we have listed what is required so you gather it before starting the application process:

A copy of your council rates (to prove your location is within the drought affected area);

A copy of your businesses 2023 tax return (or 2022 if not yet completed);

A copy of your businesses recent bank statement;

Your PIC number; and

Some kind of evidence of your spending, such as a fodder invoice, or water cartage etc plus rain decile data.

In addition to this, as you go through the application they will also provide you with a “Hardship Certification” document which needs to be filled out by your Accountant. Our whole team is aware of this and ready for when they will come through. We will fill this in and get it back to so that you can finalise your application.

Please reach out to us if you have any questions or require assistance with this process.