Planning for Longevity: Strategies for a Sustainable Future

By Michelle Salisbury

July 2024

We have the technology - Gentlemen we can rebuild him

What is your life expectancy you have factored into your future plans for yourself? Our life expectancies and quality of life are increasing as technology and knowledge develops. It’s not just a Hollywood dream of living longer and better as it was portrayed in the 80’s. As always if you fail to plan, you plan to fail and when you are elderly there may not be a lot you can do to change your situation.

Now is the time to make hay while the sun shines and plan how you can live a quality life for a long time.

Here are some important considerations:

Have a clear purpose - An important part of living a quality life is having a clear purpose. Taking some time to find your “Why” could assist with creating purpose. Check this out: A QUICK Way to Find Your WHY | Simon Sinek (youtube.com).

Knowing your “Why” gets you out of bed in the morning and gets you through tough times. Your “Why” could be discovering what you are really capable of and inspiring others along the way, or maybe it is being the best parent to your children through example. Find something that ignites your fire and make each day count. Your “Why” may transform over time too as you learn and develop yourself through our life journey.

The Accumulative Effect – “Decrepitness” is inevitable, it will happen to all of us – hopefully not until our later years.

How quickly this happens and what that looks like is made up of the effect from many small decisions you make from the beginning of your life to the end. Multiple decisions made on a daily basis can show up in long term results. This is true for all aspects of your life including your health, wealth and social choices which all have a huge impact in your future.

Maintaining the rage – to continuously perform over the long term you need to consider how you fuel yourself physically and mentally, how you recharge or recover and what motivates you both intrinsically and extrinsically.

Let’s talk about longevity

Imagine you are able to live a quality life to 120 years of age. Along the way both health and wealth will be need to continuously assessed and then balanced to ensure you are able to live well and leave a legacy for the next generation or maybe a few generations down!!

I challenge you to consider what it might look like if you live to 120.

Working backwards from 120, what does each decade look like for you? Here is mine:

110-120 – feet up, writing your memoir and reflecting on all you have achieved

100-110 – engaged in community groups, active in sport, considering next step of aged care

90-100 – eating out, ticking more items of the bucket list, planning to write your own book

80-90 – running a marathon, creating a legacy, giving back to society through volunteering

70-80 – travelling, inspiring kids through social media, mentoring business leaders

Before 70 – work like mad to fund the last 50 years!

If you set out what you would like to achieve by when, you can then start to work out how to make this happen.

Historically we plan our lives to cease paid work or employment at 65. Now with the prospect of possibly having 55 years post ‘retirement’, the age at which we formally retire and achieve other goals will almost certainly need to alter. This includes your personal goals, your financial goals and your “Why”.

Or What if?

On the flip side, if you die early have you put contingency plans in place? Do you have all the bases covered in terms of:

Will your business run seamlessly without you?

Do you have a business succession plan?

Have you planned for the transfer of your knowledge?

Have you planned for the transfer of your assets?

If the answer to these questions is yes, you’re good to go. If the answer is no, now is the time to plan.

What are your longevity goals? There is a chance that you might live longer than you’re expecting. Let’s catch up and see what that looks like for you.

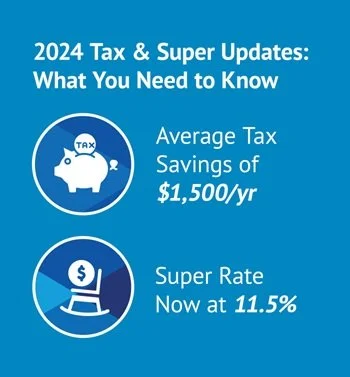

ATO Tax Rates 2024 Changes | Superannuation Rate Increase

Significant changes to the tax rates effective from 1 July 2024 are set to benefit individuals across the board. On average, these adjustments will see a typical taxpayer saving approximately $1,500 each year. Additionally, in a move to bolster future savings, the super guarantee contribution rate has been raised to 11.5%.

For a detailed overview of these changes and how they might affect you, visit the ATO's official guidelines