Planning Your Business Succession & Exit for a Comfortable Retirement

By Cameron Andrich and Pam Kloosterman

September 2024

Succession Planning For Business Owners

The dream of owning a successful business is a driving force for many Australian entrepreneurs. However, just as crucial as building and running a business is planning your exit strategy to ensure a comfortable retirement. In our experience a lot of owners don’t start thinking about the end until it’s too late which can cause not only a great deal of stress but a significant loss in business value.

With a well-thought-out exit plan and a clear vision for your retirement, you can confidently move forward into the next exciting chapter of your life, knowing that your hard work and dedication have paid off.

Start with the End in Mind

Stephen Covey’s advice to "begin with the end in mind" is particularly pertinent when it comes to planning your business exit. From the moment you launch your business, you should be considering your eventual exit. One of the first decisions you make is what structure the business will be. For example, a trust can offer great flexibility when it comes to income distributions and tax savings, but it might not be the best option when selling a business.

Start by asking yourself critical questions:

What is your ultimate goal?

Do you plan to sell to an external buyer or pass it on to a family member?

Each scenario requires a different strategy and timeline. It isn’t necessary to have a 50-page plan on your exit, but you should have at least a general outline of your objectives. By defining your end goal early, you can make strategic decisions that enhance the value of your business, making it more attractive to potential buyers or successors.

Getting Your Business Buyer-Ready

Preparing your business for sale involves more than just a valuation. It requires a comprehensive approach to ensure it is attractive to potential buyers and to make sure the goodwill of the business isn’t walking out the door with you. Here are key areas to focus on:

Financial Records: Ensure your financial records are accurate, up-to-date, and transparent. Buyers will scrutinise your books, so having clear, well-organised financial statements and tax records is crucial.

Operations: Streamline your operations to show efficiency and scalability. Document your processes and systems, highlighting areas where the business can be easily scaled or improved.

Customer Base: A loyal and diverse customer base adds significant value. Ensure you have strong relationships with your key customers and that no single customer represents too large a portion of your revenue.

Brand and Market Position: A strong brand and solid market position make your business more attractive. Invest in marketing and branding efforts that enhance your reputation and visibility in the market.

Legal and Compliance: Ensure all legal and compliance matters are in order. This includes contracts, leases, intellectual property rights, and any other legal documents important to your business.

Management Team: A capable and independent management team adds value and ensures a smoother transition. If the business relies too heavily on you as the owner, it may deter potential buyers.

Defining a Comfortable Retirement

What does a "comfortable" retirement mean to you? This is a deeply personal question and varies significantly among individuals. A comfortable retirement generally means having enough financial security to cover your living expenses, health care, leisure activities, and any other personal interests without causing undue stress or financial strain.

To ensure a business retirement planning, consider the following:

Assess Your Financial Needs: Calculate how much money you will need to support your desired lifestyle in retirement. Factor in everything you can possibly think of. For a lot of people, it costs a lot more to live the lifestyle you want than you think.

Superannuation: Maximise your superannuation contributions and take advantage of the tax benefits available. It is a good idea to regularly review your superannuation fund's performance and risk profile and adjust your strategy as needed.

Investments: Do you have investments outside of superannuation? Diversifying your investments will ensure a steady income stream during retirement. Consider a mix of property, shares, and other investment vehicles that align with your risk tolerance and retirement goals.

Lifestyle Planning: Think about where you want to live and how you want to spend your time in retirement. Whether it's travelling, pursuing hobbies, or spending time with family, having a clear vision of your retirement lifestyle will help you plan accordingly.

Trademark: Protect your brand from being copied.

Exiting your business and transitioning into a comfortable retirement requires careful planning and strategic execution. Remember, the earlier you start planning, the better prepared you will be to achieve your goals and enjoy the fruits of your labour.

Need help planning your business exit or comfortable retirement? We can help guide you through the process and assist you to make informed decisions. Call us on (08) 9841 1200 to make a start.

Right to Disconnect Law Australia

Key Facts for Employers

After much ado and a lot of press, the right to disconnect laws have now been implemented by the Fair Work Commission.

Intended to restore the boundary around employees’ personal time and create a safeguard for that time, the laws came into effect on 26 August 2024 for national employers with 15 or more employees. These laws will come into effect for small businesses in the national system (less than 15 employees) on 26 August 2025, giving them additional time to adjust to the new laws.

What is the right to disconnect?

The right to disconnect grants employees the right to refuse to monitor, read or respond to contact or attempted contact from their employer or related third parties outside of the employee’s working hours so long as the refusal is reasonable. This covers any type of contact e.g. email, phone, text, online messages.

For clarity, the right to disconnect won’t prohibit employers from contacting employees after hours. Rather it is a prohibition on expecting or demanding a response so long as the refusal is deemed to be reasonable.

It is essentially a legislated “off switch” in situations where employers’ demands are unreasonable.

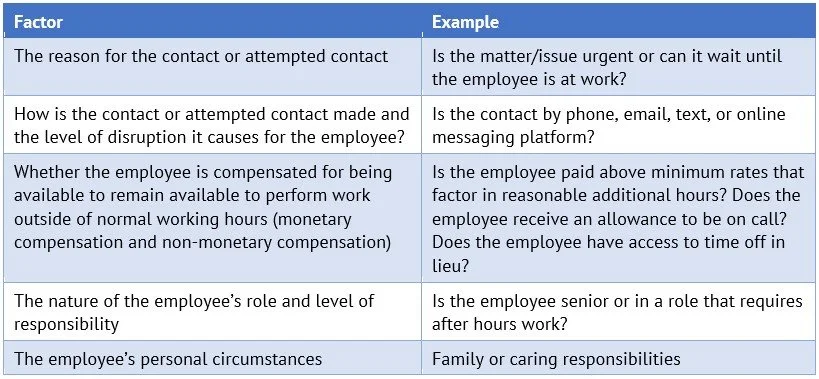

What is considered reasonable?

What is considered reasonable requires a holistic assessment of all the factors below. These should be considered before contacting an employee out of hours.

Note – An employee’s access to the 'right to disconnect law' may be limited for employees in senior positions who are well remunerated.

Disputes

The first step in resolving a dispute around after hours contact is at the workplace level. If a dispute can’t be resolved in the workplace, the employee or the employer will be able to go to the Fair Work Commission. The Fair Work Commission will have the power to determine whether an employee’s refusal was ‘unreasonable’ or not and can issue stop orders. This means the Fair Work Commission will be able to order an employer to stop making unreasonable contact with an employee. They can also issue a stop order to employees to stop them from reasonably refusing out of hours contact. Once a stop order has been imposed, any breach of this could result in penalties.

What you should be doing

Review how work is being allocated and who it is being allocated to. Understand work distribution and employees’ working days.

Consider whether policies need to be updated, eg create a policy on working reasonable additional hours and what is considered reasonable contact plus amend your IT policy regarding the use of technology out of hours.

Provide training to managers on appropriate and reasonable contact with employees.

Increase third parties’ awareness of the right to disconnect, e.g. consider confirming an employee’s availability in email signature blocks.

Review employment contracts, eg include key clauses outlining the span of hours worked and the remuneration clause to ensure it is inclusive of reasonable additional hours.

If necessary, amend existing employment contracts for certain employees to include reference to reasonable additional hours, and being clear on the compensation applied to be available after hours to deal with time critical issues.

Update position descriptions, eg do they state out of hours contact is a requirement or a responsibility that carries the inherent responsibility for the person to be available out of hours.

Need Help? If you need any assistance or would like further information on this, please reach out to us at on (08) 9841 1200.