Cruel Intentions

By Carryn Hills

Are you considering building a new house? Or have you built a house recently as owner-builder? As if the process isn't stressful enough... choosing tiles, flooring, picking the difference between "vivid white" and "white on white" wall colour, we may be about to cause you another head ache.

There are some common errors that crop up when we deal with property and the associated GST. While they might not affect everyone we might all be exposed to them at some point or another. Let’s take a look at a few examples.

Enterprise or not?

Many people are actually carrying on an enterprise when making property transactions but do not register for GST when they are required to do so. Even if you are not in business, you may still be required to register for GST as one-off property transactions may be considered carrying on an enterprise.

So what differentiates selling a property as an enterprise vs. not? It all comes down to intention. If you buy property with the intention of immediate resale at a profit or you develop property to sell – you might be considered to be conducting an enterprise.

Selling residential property

When would you not have to include property that you have sold with the intention of making a profit? If the sale of the residence is not new residential premises.

But what is new residential premises?

If it has not been sold as a residential premises before;

Has not been rented out continuously for five years since its been constructed; or

Has undergone substantial renovations.

So let’s look at Joe in 3 different scenarios.

Firstly, Joe builds a house which is to be his family home. Two years after it’s been completed, he gets relocated to Perth and has to sell his home. Would he be liable for GST? No. Although the property would be considered new, the intention is for the property to have been for private purposes and it would not be considered to be the carrying on of an enterprise.

In scenario two, Joe is already registered for GST for his construction business. He builds an investment property with the intention of selling it when the time is right. He is not able to sell the property straightaway and manages to lease it for a period of 3 years before finding a buyer for his property. Would he be liable for GST? While the rental income earned and rental expenses paid for the period of the three years is not subject to GST, the actual sale of the property would incur GST as it is still considered to be new residential premises. This is because the property has not been rented continuously for five years. He would be able to offset the GST paid on the construction against the GST on the sale.

Scenario three has Joe building a property with the intention of immediate sale, he is aware that the transaction would incur GST but as the market is flat decides to rent the property while advertising it for sale. This continues for five years. Would Joe be liable for GST? Yes – this would still be considered a new premises due to the intention of resale regardless of the fact that it’s been rented continuously for five years.

Commercial property

Whilst we are talking about GST on property transactions, we also need to mention that GST does not always apply to commercial properties and farmland.

The sale of commercial properties will generally need to have GST included in the sale price unless it is the sale of a going concern. The sale of a going concern occurs when the business is sold including all of the things necessary for the new owners to continue to operate the business. For example, Joe’s wife Mary had to sell her hair salon when they moved to Perth. Included in the sale agreement was the business premises, all furniture and fixtures, plant and equipment and the client list. Basically Mary walked out as the new owners walked in, business as usual. Please note a commercial leased property can also be a sale of a going concern and GST free if all leases, agreements and covenants are included in the sale agreement.

Farmland will also be GST free if the land being sold was used for farming for at least 5 years immediately before the sale and the buyer intends to use it for farming. Originally Joe and Mary were sheep farmers before they made a sea change to Albany to open Mary’s Hair Salon and Joe decided to build their new family home. Joe and Mary sold the farm to a property developer who intends to subdivide the property. Joe and Mary were required to charge GST on the sale as the buyer had no intention of farming the land.

Not sure?

As with all things, when in doubt come and see us so that we can work out what your obligations are and assist you in calculating the correct GST payable.

Make a splash!

The team at Lincolns have signed up to help raise funds for Western Australians living with Multiple Sclerosis (MS), by taking part in the MSWA Swim.

MS is the most common degenerative neurological condition diagnosed in young people aged 25-40 years. And, it affects three times as many women as men.

Please help support people living with MS and other neurological conditions, by donating today https://mswaswim.org.au/champion/albany-2017/LincolnsLappers

No need to remind you that donations over $2 are tax deductible.

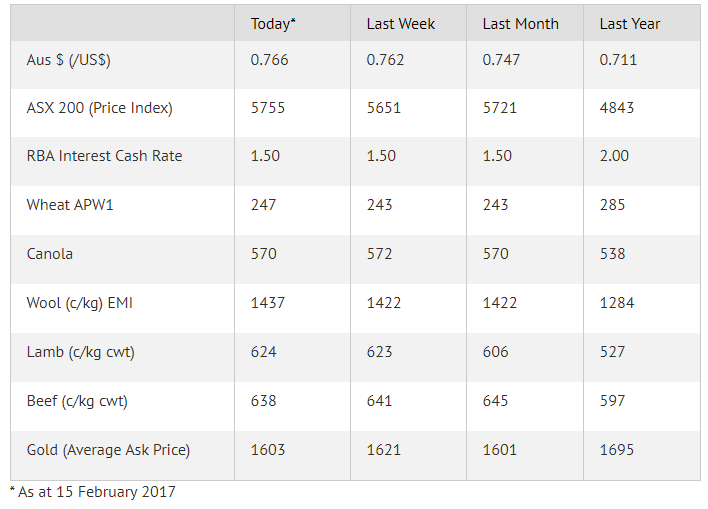

Commodities

A coffee with ...

We are very excited to be launching our now monthly feature called "A Coffee With..." In our first edition, Craig Anderson caught up with Chris O’Keefe from O’Keefes Paints over a coffee and chatted about his journey in business here in Albany.

Click here to read the full article.