Time for a fresh set of eyes?

By Chrissie Smith

What do you think when I say bookkeeping?

Paying bills, hunting for receipts, entering payroll, long nights spent reconciling bank accounts, not to mention the dreaded BAS? Most of the time it is a job that gets left until the last minute and is only done to meet ATO lodgement obligations.

Today I am hoping you will come away with a newfound respect for bookkeeping.

Bookkeeping has changed a lot over the years, largely due to advances in technology. Confirmation of bank transactions is more readily available allowing businesses to make informed decisions with real time information. It makes sense to be making decisions based on what is happening now rather than what was happening three months ago.

Having a good bookkeeper is like having an extra set of eyes. With money going in all directions it is great to have the support of someone to assist in pointing out excellent opportunities or raising red flags. As long as you have the time and energy to do something with this new found information.

Now as a business owner, ask yourself … Do you really know what state your books are in?

What are the signs of a great bookkeeper?

A professional bookkeeper has many qualities that business owners should be looking for when choosing the right bookkeeper for their business:

Reliable and trustworthy – goes without saying really!

Well informed and able to provide the business with up to date and customised financial reports.

Organised and their attention to detail needs to be faultless.

Good communicator – talk the talk and walk the walk!

Regularly updates their knowledge - important that they are keeping up to date with new tax and business regulations.

Understands your industry – or even better, they make a point of asking the questions to understand your business.

Sees the big picture – supports and allows the business owner to concentrate on perfecting and building a forever evolving business.

How Lincolns Beyond Bookkeeping can help you

Here at Lincolns Beyond Bookkeeping we can provide you with a trusted and cost-effective bookkeeping service. Rest assured that your end of month procedures are in good hands, no longer will you have to worry yourself with data entry tasks, payroll demands and reconciliations. Allowing you the time to really concentrate on what you do best, and that … is running your business!

And it doesn't stop there. Since launching our bookkeeping division in April we have assisted many clients in other areas including

Setting up new data files

Data file makeovers and upgrading software

Setting up payroll, including back packer tax changes

Setting up superannuation clearing house

Wage reconciliations and preparing PAYG payment summaries

Reconciling bank accounts and clearing accounts

Resolving petty cash issues

The list goes on

If you would like to learn more about our bookkeeping division please, click here.

Free offer

Now is the time to start the new financial year in a more positive, productive environment, supported by the team at Lincolns.

We would also like to announce, for anyone who signs up with Lincolns Beyond Bookkeeping before 31 July, you will receive a free one hour session on business management.

If you would like more information on our Bookkeeping service, call Kelly on 9841 1200.

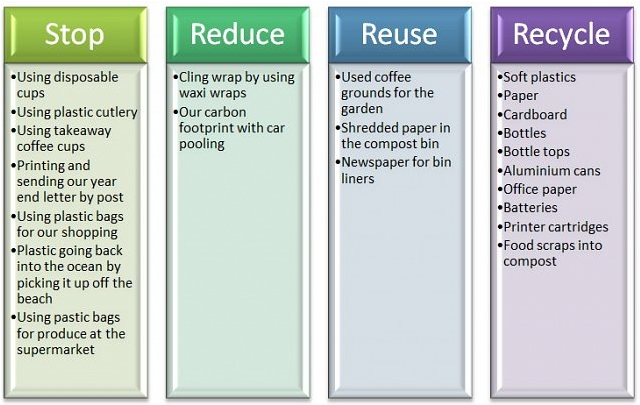

The Lincolns War on Waste

By Jenni Leonard

Inspired by the recent TV series on the ABC, War on Waste, the Lincolns team have embarked on a campaign to reduce our own waste and stop as much as possible going to landfill. We’re pretty pleased with what we’ve been able to achieve through this process both in the office and in our own personal lives:

We’d love to hear from you if you have other ideas we can take on board to help ease the load on our precious planet.

Congratulations to Phil Mortimer

We are delighted to share with you the news that Phil Mortimer was promoted to a Manager on 1 July 2017.

Phil joined Lincolns in 2009 and provides taxation and business advice. Phil specialises in aged care and wine equalisation tax.