The Accelerating Growth in Technology

By Cameron Andrich

You’ve got the skills and enough hands-on experience working for someone else. Now it’s time to get out on your own and build your own empire. With plenty of fire in your belly and pure determination you are ready to go for it. Or maybe you are already on this journey and need some inspiration and assistance to continue to grow.

There are so many aspects of this chosen path that may be daunting and confusing at times.

Transition tips

Begin thinking like a business owner. Look at the big picture and make plans for the future. Engage in a brain storming session and use the results of this as a starting point. Develop a business plan and cashflow forecast – we can assist with this so don’t be afraid to reach out. We can also help you plan for cashflow items such as Tax, GST, and superannuation payments.

Make good business contacts with people who have different skill sets to yourself. For example, get to know someone who is a marketing guru or maybe someone who is brilliant with technology. Go to local networking groups to gain a wider range of contacts.

Look for ways to constantly evolve your leadership skills. Do a short course, read a book, maybe watch something from the net or even find short clips on You Tube.

Get good at understanding and reading financial figures – so you can better make strategic business decisions. Ask your accountant questions, compare your results from year to year, talk to other business owners about the numbers. It’s a language worth learning. There are industry benchmarks that you can use to see how you compare to others in the same industry as yourself.

Set budgets for jobs and monitor their progress. Compare the outcome of one job to a similar job, then critique your performance. Don’t be afraid to charge what you are worth – believe in yourself.

Refine the processes you have put in place in your business to continuously improve your business’s efficiency and productivity.

Set up your business structure

When looking at an appropriate business structure, you need to consider the needs involved with your business and your personal position. Protection of your personal assets from business risk is an important issue to consider. Which structure suits your situation will differ and needs to be discussed with your business advisor here at Lincolns before starting on your new adventure.

The various structures you can trade under include:

Sole Trader

Partnership

Trust

Company

Each of these structure options have differing costs and asset protection levels. These can be tailored to suit your needs.

Getting started checklist

Here is a ‘to do list’ for starting a business:

Sort out your business structure

Prepare a cashflow budget

Create a business plan

Register for GST

Register your business name (ABN)

Setup a bank account

Sort out insurances

Setup your accounting software

Apply for industry licenses

Market your business

Get your HR systems in order if you’re going to employ people

For more details see our New Business Handbook.

Need help getting started?

Don’t be shy in asking for assistance. It’s very hard to do it all yourself. So, we can help with:

BAS preparation

Cash Flows

Business Advisory services

Software support

Human Resources

Financial Statement preparation

IT support

Just to name a few you will need along your journey.

If you require some assistance with any of the above or would like some more information, then please speak to your accountant or give us a call on 9841 1200.

Using AUSKey? Migrate to myGOVID now!

By Rodney Russell

If you use an AUSKey to access the Australian Tax Office (ATO) online, you will need to move to their new authentication system, myGovID before the end of March.

Don’t wait until the end of March to migrate. It’s easy and only takes a few minutes.

myGOVID is different to myGov

What you need to do

Currently, the myGovID app is only available for iPhone and Android based devices.

iPhone: https://itunes.apple.com/au/app/mygovid/id1397699449?mt=8

Android: https://play.google.com/store/apps/details?id=au.gov.ato.mygovid.droid

If the app doesn’t appear when your search myGovID, then your device may not be compatible.

To setup your myGovID, you will need to have at least two of the following Australian identity documents to achieve a Standard identity strength (your name must match in all):

Passport (not more than three years expired)

Driver’s License (including learner permit)

Birth Certificate

Medicare Card

Once you have setup your myGovID you can log into the Relationship Authorisation Manager (RAM) to link your business and continue using the ATO online services.

Link your ABN to your myGovID in RAM

Before you start, check your ABN details are up to date in the Australian Business Register (ABR) to ensure RAM uses the correct information.

To link your ABN to your myGovID in RAM, you'll need to be the principal authority that is, either:

A sole trader

An eligible individual associate listed on an ABN in the ABR, such as a trustee, director or partner

A primary person (no individual associates listed in the ABR) such as a corporate trustee, authorised contact for a government agency or responsible person for an Australian charity.

Once you have setup your myGovID and linked your ABN in RAM, you can continue to use online services such as the ATO.

Need help?

For further information or help, please see https://www.abr.gov.au/auskey/your-auskey-replacement

Or if you need assistance to set this up, please contact us on 9841 1200.

Annualised wages - changes coming into effect on 1 March 2020

By Jenni Leonard

On 1 March 2020 a number of modern Awards will be amended to include or expand on the provisions governing annualised wages. Some awards, eg the Clerks - Private Sector Award 2010, will have existing provisions replaced by a new standard clause. Some other awards under which employees work highly variable hours or significant ordinary hours, eg the Pastoral Award 2010, will have a new annualised wages clause inserted.

Which awards will contain new annualised wage provisions on 1 March?

The new annualised wage provisions will take effect on 1 March 2020 in the following Awards:

Banking, Finance and Insurance Award 2010

Broadcasting and Recorded Equipment Award 2010

Clerks - Private Sector Award 2010

Contract Call Centres Award 2010

Horticulture Award 2010

Hospitality Industry (General) Award

Hydrocarbons Industry (Upstream) Award 2010

Legal Services Award 2010

Local Government Industry Award 2010

Manufacturing and Associated Industries and Occupations Award 2010

Marine Towage Award 2010

Mining Industry Award 2010

Oil Refining and Manufacturing Award 2010

Pastoral Award 2010

Pharmacy Industry Award 2010

Rail Industry Award 2010

Restaurant Industry Award 2010

Salt Industry Award 2010

Telecommunications Services Award 2010

Water Industry Award 2010

Wool Storage, Sampling and Testing Award 2010

What are the new provisions?

Under the new annualised wage arrangements, the employee need only be better off overall over the course of a 12 month period, rather than across a pay cycle.

Under the new clause, you will need to advise a full-time employee of:

The annualised wage that is payable;

Which of the provisions of the award that will be satisfied by payment of the annualised wage;

The method by which the annualised wage has been calculated, including specification of each separate component of the annualised wage and any overtime or penalty assumptions used in the calculation;

The outer limit number of ordinary hours which would attract the payment of a penalty rate under the award and the outer limit number of overtime hours which an employee may be required to work in a pay cycle without being entitled to an amount above the annualised salary.

Employers also need to:

ensure they keep written, signed records of each employee's start time, finish time, unpaid breaks and overtime (electronic records are fine); and

conduct reviews of annualised wage arrangements against award entitlements every 12 months.

It should be noted that you can continue to use "offsetting" in an employment contract, particularly when an employee's pay is sufficient to cover their minimum entitlements under the award in each pay period. However, where the amount of overtime an employee works over the year varies significantly it is possible that the employee's wage in a pay cycle is not enough to cover minimum award entitlements. For these employees, the new annualised wage provisions allow you to consider an employee's wage across the year (rather than a pay cycle) and therefore you are not in breach of the award for not paying the employee's minimum entitlements in a particular pay period. Naturally, if an employee's wage over a year is less than their entitlement this would need to be rectified following an annual reconciliation.

Why are these changes coming?

The changes are being put in place to protect employees and to ensure that employees on annualised wage are not disadvantaged or underpaid.

Key messages for employers

Make sure you familiarise yourself with the new annualised wage provisions in the award and understand what they mean for you and your employees;

Review your time and record pratices to ensure they comply with the requirements;

Make sure your employment contract is worded correctly;

Make sure any employees on annual salaries are being paid for all the hours they work in a pay cycle;

Identify which employees should be on an annualised wage arrangement to avoid breaches of the award.

Need help?

Many employers are understandably confused by these changes. If you need help with implementing these changes in your business, call us on 9841 1200.

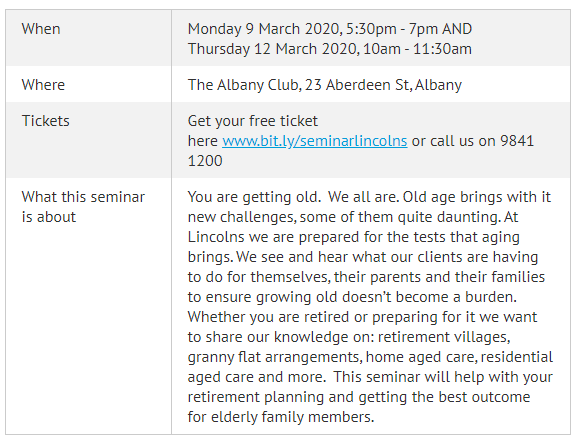

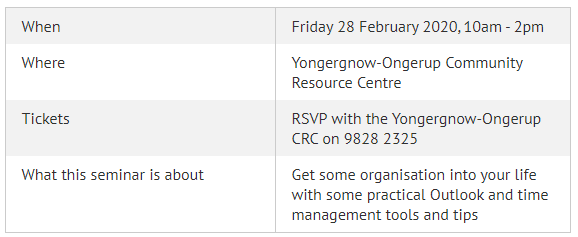

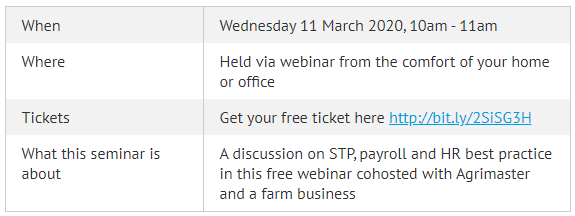

Upcoming seminars

We have a number of free seminars coming up over the next month, all aimed at helping you to grow your knowledge in a wide range of areas.