2021 Budget. A beaut or a bungle?

By Phillip Mortimer

Mr Speaker…

In keeping with my annual tradition, I watched the Treasurer of the day deliver his Budget speech to the Parliament (a bit sad, I know). This year Mr Josh Frydenberg was going to give a Budget for the history books. Floods, bush fires and, of course, the pandemic had pushed Australia into recession for the first time in nearly three decades.

This time it certainly was different. It was five months later than usual. The Parliament clerks and attendants wore face masks. The Lower House was social distancing and many parliamentarians weren’t allowed to attend. The obligatory interjections of ‘hear, hear’ from the government benches was lower in volume, so were the chuckles from the opposition. Congratulatory handshakes and kisses to the Treasurer converted to elbow touches.

Of course, there were the numbers and policy announcements. I’m not going to go through all of these. What needs to be known is that Mr Frydenberg predicts this Budget will deliver strong GDP growth. This is aided by a vaccine being available in the near future, all the government expenditure announcements, the business incentives and personal tax cuts to get people spending again. All going to plan, the fall in GDP of 0.2% for the 12 months to June 2020 will be followed by growth of 4.75% for the year ending June 2021. Let’s hope he’s on the money.

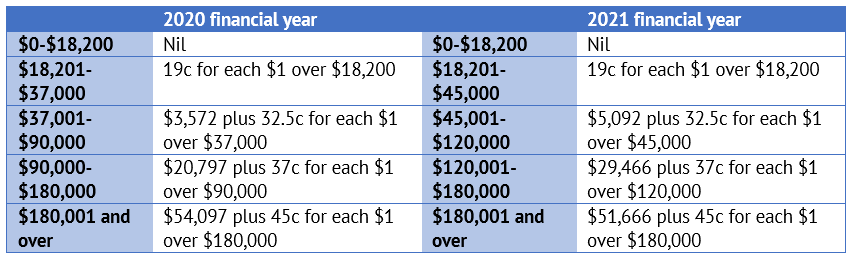

The first notable announcement was bringing forward and back-dating to 1 July 2020 the changes to the marginal personal tax rates. These are:

To give examples of the effect of these changes, if you earn:

$40,000 you will be $1,060 better off

$80,000 you will be better off by $2,160

$140,000 and above you will have $2,565 more in your pocket

Last year’s temporary measure of up to $1,080 through the Low and Middle Income Tax Offset for those earning up to $90,000 will continue for another year. This will add to the tax savings mentioned above. Those earning less than $37,000 will also benefit with the Low Income Tax Offset increasing from $445 to $700.

People on government income support with a health card or seniors card will receive $250 in November and another payment early next year. This follows the two $750 payments made since the COVID-19 measures commenced.

With the Productivity Commission on aged care to report in February, no major announcements are expected in this space until after the release of the findings. Another 23,000 home care packages will be available, allowing more people in need to stay at home longer and shorter waiting periods for help in the home.

But it was businesses that are clearly the main beneficiaries of this Budget. The benefits for business include:

Instant write off of all new eligible plant and equipment bought from Budget night and installed and ready for use by 30 June 2022 for all businesses with turnover less than $5 billion. This excludes buildings. For small and medium sized businesses with turnovers less than $50 million, second-hand goods are included.

Small business with turnover of less than $10 million can deduct the entire balance of their plant and equipment small business pool by 30 June 2022.

Businesses with turnovers between $50 and $500 million can claim an immediate deduction for eligible new and second-hand assets less than $150,000 if bought by 31 December 2020 and installed ready for use by 30 June 2021.

JobMaker will be available for employers who take on 16 to 35 year olds currently out of work. This is a hiring credit of $200 per week for employees aged 16 to 29 and $100 per week for employees aged 30 to 35. However, employers that are receiving JobKeeper will not be eligible.

Employers with apprentices will receive 50% wage subsidies for eligible new apprentices.

Eligible companies will be able to claim tax losses they may incur up to June 2022 and use these to offset profits made on or after the 2018/19 financial year.

The research & development (R&D) tax incentives will change from 1 July 2021. Small R&D entities will now get a tax offset of 18.5% above their tax rate with no refundable limit. Large R&D entities will have tiered offsets above their tax rate of 8.5% and 16.5%.

At this point the JobKeeper payments will continue as previously announced but the door has been left open to continue this subsidy if the government sees the need.

As during all Budgets, an announcement on targeted spending was declared. Very large amounts of money are to be spent on infrastructure, health (particularly mental health), education, the NDIS program and water security. Much of this expenditure was already public knowledge though some new spending was announced.

There will be much press coverage on the size of government debt. Headlines of large numbers and as a huge percentage of GDP will abound. Depending on who you speak to, this could be both good and bad, though it’s the cost of this debt that needs to be taken into account. When the government can currently borrow for 10 years at 0.25%, the cost to the taxpayer is (relatively) cheap. And the RBA is doing its utmost to ensure interest rates stay at these levels, if not lower. Imagine if you and I could borrow at that rate.

So the Budget has come and gone again. It has been a difficult year for lots of us, including the government. For us in the Great Southern it feels like we have been in the lucky part of the lucky country. Spare a thought for those in Melbourne and many places overseas. Add to that many in the work force who have never endured a recession. The uncertainties are still there. Help is out there beyond saving dollars through tax changes and incentives.

Whilst the Budget isn’t a cure-all to mend everyone’s financial woes, we at Lincolns can assist you to personalise your budget preparations to make your life a bit more certain. Talk to us today on 9841 1200.

Watch the Budget Recovery Project

Creating a recovery plan through COVID to get your business back on track.

Brendan Taylor and Carryn Hills hosted a free 4-part webinar series to assist businesses following the inevitable end of government support.

Each week we discussed a new topic. You are able to catch up on previous weeks by viewing the recordings.

A Coffee With… Paul

A few months ago, we managed to sit our newest partner down and pull out his journey from longhaired IT guy too suave and bearded Lincolns Partner, Paul Meaton.

The journey for Paul has not been linear, although the best stories never are…