Neither a borrower or lender be…

By Phillip Mortimer

Debt has its purpose when used properly. It can get you a home or car. It can help you expand your business. It is a form of forced savings for retirement. But it can also get you into trouble.

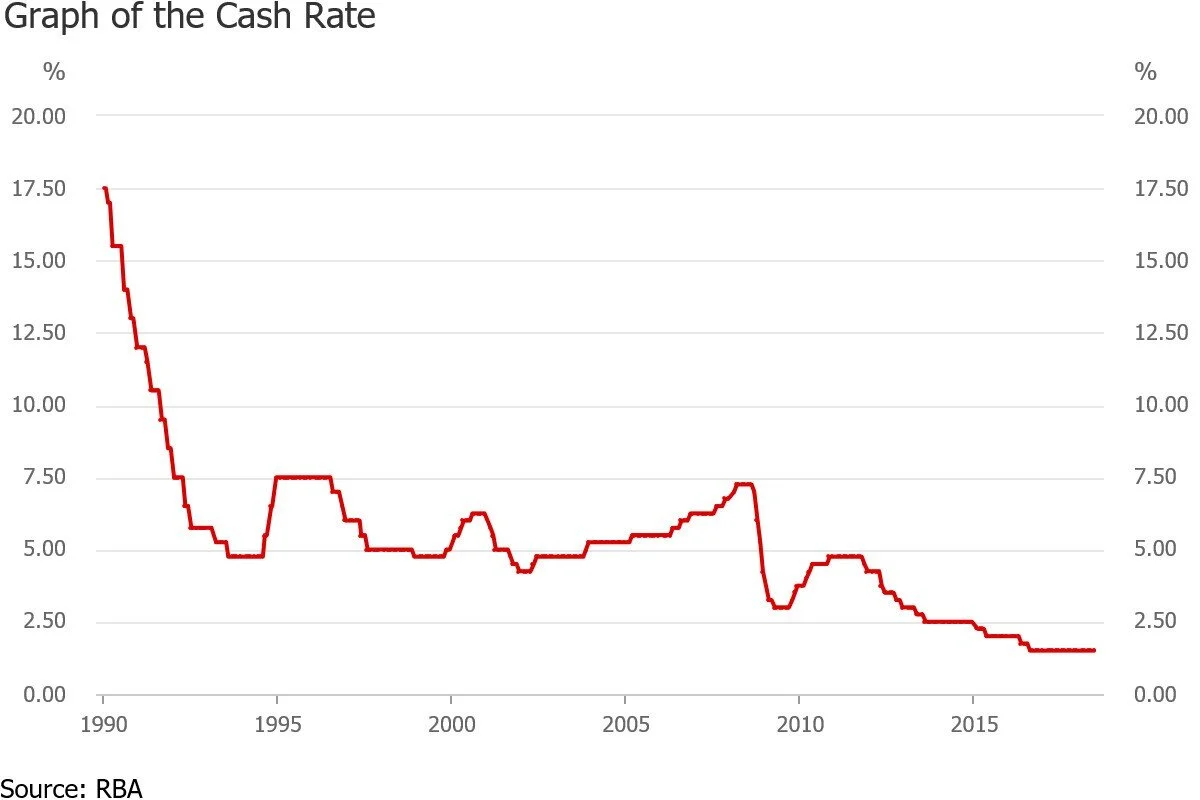

The cost of borrowing is, of course, the interest rate charged. Below is a graph showing the Reserve Bank of Australia Cash Rate for the last 30 years. This is the basis of interest rates charged by financial institutions in Australia. There are other factors but this is the most relevant. And as you can see current interest rates are at historical lows.

You may look at this graph and say to yourself that it is a good time to be borrowing as the cost to do so is cheap. However, you need to remind yourself that interest rates do not remain static. Though most experts believe the RBA will not start to put interest rates up until late in 2019 or early 2020, they agree interest will go up at some point.

There is a double-whammy to rising interest rates and these are:

The cost to service your loan increases; and

Asset prices, in general, will fall.

The opposite occurs when interest rates fall.

The beauty of interest rates being so low is it gives you the chance to reduce your debt. So what’s the best way to go about this? Making the same payments against your loan when rates were higher will see the principal of your loan reducing quicker when rates fall.

So which debts do you tackle first? As mentioned earlier, debt can be good but not all debt. The first thing to consider is whether or not the interest cost of the debt can be used as a tax deduction. If not, this non-deductible debt needs to go.

Non-deductible debt usually comes in the following forms:

Mortgages – a necessity for most people who want to own their home. Lots of hoops to go through with the banks asking plenty of questions. The banks won’t give you the full price of the house as they want you to have some equity. The bank will expect regular payments, though up to periods of 30 years, to cover the interest and loan principal. Also, a mortgage gives the right to the bank to sell your place if you can’t pay back the loan. For these reasons interest rate charged will be the cheapest going around for personal lenders.

Personal loans – usually for purchases such as cars and items like furniture and white goods. Normally there is less paperwork to complete but the bank will expect the loan to be paid back in a relatively short period, up to 5 to 7 years. Banks still have a hold over the asset until the loan is repaid and interest rates are fairly cheap.

Credit Cards – easy to get, easy to use and easy to abuse. There is no security required so the interest rate is high, nearly 20% for some cards even in this low interest environment.

For businesses, interest costs are usually deductible and loans are used for various purposes. These include:

Purchasing plant and equipment.

Covering short-term cash flow shortfalls when payables and receivables don’t match.

Initial capital to start a new business.

What businesses need to consider is why they are borrowing. Is it purchasing useful assets or funding growth in the business? Or is it merely covering cash-flow deficiencies? To answer these questions businesses need to know where the money is coming from and where it is going. For example, a business may be experiencing profit growth and needing new plant and equipment to be purchased. To increase sales it could see more debtors taking longer to pay. Both scenarios stretch the cash available despite a healthy profit. Debt is then needed to manage such a situation.

The other consideration for businesses is whether the timing of debt matches the purpose for the debt. For instance, to extend an overdraft, which is expensive and can be called in by the bank at any point, should not be used to purchase an item of equipment that is utilised over many years. For such purchases loans such as chattel mortgages are a more suitable form of borrowing.

“Neither a borrower or lender be” Polonius advised his son Laertes. This may have been practical in the time of Hamlet but modern life finds most of us calling on some form of debt. Governments, business and individuals seek financial assistance by way of borrowing from someone else, be it a bank, other business or friends and family. But debt needs to be managed properly. So if you feel your debt is getting out of hand or not matching what it is used for, please let Lincolns help you avoid the debt traps.