Size matters ... why it pays to be a small business

By Thomas Warner

Did you know that being classified as a small business gives you access to more than a dozen potential tax savings, concessions and reliefs that the big end of town do not get? Today we uncover what it means to be a small business and the concessions available depending on your gross income.

How do I know if I am a small business?

To be classified as a small business you must be carrying on a business and your gross income needs to be below a certain threshold. Your combined gross income must be below the relevant threshold in either:

The current year;

The prior year (look back); or

The next year provided you did not exceed the threshold in the past two years (look forward)

Your gross income is your total sales (exclusive of GST) before taking off expenses. Other non-business income such as interest, dividends and rental income does not form part of your gross income. Please be aware you may have to include business income from other entities you are connected or affiliated with (combined income).

The combined gross income thresholds are under $2 million, under $5 million, under $10 million and under $25 milliion. Let’s have a look at each of them.

Under $2 million gross combined income

Provided you are carrying on a business with a combined gross income of less than $2 million, you will be able to access the Small Business Capital Gains Tax (CGT) Concessions.

CGT concessions allow businesses to sell an active asset (asset used in your business) to disregard or defer the amount of capital gain, depending on your circumstances. CGT concessions may also be available if your gross income is above $2 million although your net assets are below $6 million.

Under $5 million gross combined income

If your combined gross income is less than $5 million you have access to the Small Business Income Tax Offset.

Individuals who receive business income as a sole trader or via a distribution from a trust or partnership may be entitled to this tax offset. The maximum offset available is $1,000 per person per year.

Under $10 million gross combined income

If your combined gross income is less than $10 million, you have access to a huge list of potential tax concessions, reliefs and savings.

Simplified depreciation rules - allow small businesses to instantly claim a tax deduction for the purchase of any plant and equipment costing less than $20,000 until 30 June 2019. Larger items are allocated to a pool and a flat rate of depreciation is claimed each year.

Simplified trading stock rules - means that instead of doing a physical stocktake you can estimate your closing stock value provided the movement for the year is less than $5,000.

Ability to restructure without tax consequences - means that small businesses who have been setup in the wrong structure or have outgrown their current structure can potentially change their entity type (partnership, trust or company) without causing a tax headache.

Immediate deduction for prepaid expenses - allow small businesses to prepay expenses for 12 months and claim the full deduction when the payment is made. Larger businesses are required to apportion the expense over the two tax years. This is a great tax planning tool.

GST reporting on a cash basis - means that GST is paid to the Tax Office when income is received and expenses are paid rather than when they are invoiced. This can assist with cashflow as the money has already been received before it needs to be remitted to the Tax Office. Small businesses also have less information to report on their BAS thanks to the “Simpler BAS”.

Small Business Superannuation Clearing House - is a free service small business employers can use to make their superannuation guarantee contributions.

Under $25 million gross combined income

For companies with a combined gross income of less than $25 million, they pay the reduced corporate tax rate of 27.5% compared to 30% for large companies. The corporate tax rate will reduce to 26% in 2020/21 then 25% in 2021/22.

Need more help?

As you can see, being called a small business is not a bad thing as it opens up a world of tax deductions, concessions, reliefs and savings. To see if your business counts as a small business and to take advantage of all the possible concessions please contact the team at Lincolns.

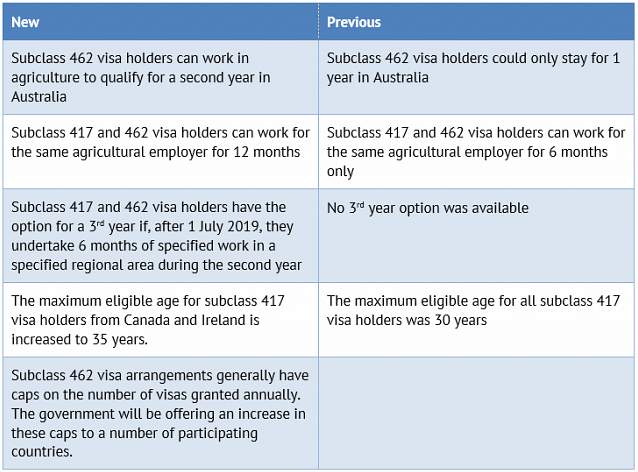

Changes to the working holiday maker visa programme

Earlier this month, the Government announced changes to the Working Holiday Maker visa programme. The changes have been implemented to better support regional and rural communities and provide farmers with better access to seasonal workers.

Here is a summary of the changes compared to the previous arrangements: