Have your smashed avo and eat it too

By Sabina Moir

Housing affordability, whinging Gen Y, smashed avocado, take away coffee addictions, expensive university fees, blah blah blah! Too many excuses when all you need is good financial management to get you to where you need to be!

Please note – all individual situations are different so take what you need from this article!

Needs vs wants

Remember in Year 1 when you learned the difference between needs and wants? Well there is a reason why you learnt that from an early age, as learning to differentiate between the two is extremely important in your financial management. DO spend money on your needs! Food, health, rent, mortgage repayments, utility bills, fuel for your car. BUT be very mindful of your spending on wants as your choice on whether to spend money on these wants can either make or break your good financial management.

Unnecessary wants

Most of our wants are things – fast fashion, useless home wares, another Bali holiday, the latest tech gadget, junk from the shopping mall. Unnecessary material things that we think we need and can burn a hole in our wallets. More often than not, the feeling of ecstasy when we are making the purchase of a want quickly wears off. However, the lower bank balance doesn’t go away quite as quickly. There is nothing worse than looking at an unhealthy bank balance and seeing the main culprit being an unnecessary want that you just had to purchase.

Keep a diary

Always monitor what you spend! To get started, keep an income and expense diary for one month to see where all your dollars go. At the end of the month split all your spending into wants and needs and then set yourself a goal for the next month to reduce your spending on those unnecessary wants. You may even find that after a month or two you are left over with a cash surplus.

Save save save

Did you know that 50% of all Australians live week to week and have no savings to speak of? Well this doesn’t need to be you! It’s a great feeling knowing that you have some dollars saved up in a bank account earning the best interest rate going around. Saving gives you options and can also be that emergency fund if something goes wrong (so no need to ring Mum and Dad to help bail you out). Saving also can allow you to splurge on a want every once in a while, ie overpriced smashed avocado on toast and a green kale smoothie?

Check your job

Remember when Joe Hockey said that Australians wanting to buy their first home should get a good job that pays good money? Well there is some truth in that statement in that you should think about your current role or if you are studying about how much your job could potentially/will pay you. If it isn’t the type of dollars that you are after then you’d better steer clear of that profession or educate yourself so you can climb the ranks in your current role in order to get that pay rise.

Be brave

You’ve got be a bit brave and have the guts to fight for your financial management and that doesn’t mean throwing a punch at your bank manager when discussing interest rates or at your boss when you ask for a pay rise. Take re-financing your mortgage to another bank. Your current bank will put up resistance and put you through hell as they don’t want to lose you as a customer. Unfortunately these tactics usually work for them as many customers tend to back down. However it is worth it to be brave and to put up a fight as re-financing could potentially save you thousands of dollars in interest.

Don't be lazy and expect mistakes

Pardon the pun but you cannot afford to be lazy with your financial management – this could mean taking the time to do some research and asking questions. If you are unsure of what that bank fee is or why your interest rate appears a bit higher, it would do you good to ask the question as people do make mistakes! No one wants to be out of pocket due another person’s brain fade.

Have a good accountant

If you’re sick you go to a doctor, if you have a legal issue you go to lawyer. This may seem obvious, but why? It is because they are an expert in their field due to many years of gruelling study and experience working in the industry. Accountants are no different. They are the experts in the field of money and are here to help you with your financial management. Let us be your first port of call with your money – especially before you go to the bank to ask for a loan.

Let the only debt you ever have be your mortgage

Unless it indispensable, try not to have debt. ESPECIALLY debt taken out to purchase an unnecessary want. Remember that debt is NOT your money, it’s someone else’s and they will not let you get away without paying a price. If you do have a credit card, make sure that you pay them off enough so that you don’t end up paying the credit provider any interest!

Be realistic

Guess what? Life is not a fairy tale and it is highly likely that you will not become a celebrity, AFL player or lottery winner so don’t dream for these things! You’ll probably end up being an average 9-5 worker who will need to make smart decisions with their financial management. Also did you know that the average professional sportsperson is broke after five years of retiring from their sport? That stat should make you think of better avenues to achieving your optimum financial situation.

Good financial management takes time and practice but once you start taking charge and making good decisions you will reap the benefits! Need some help to get on the right path, call us now on 9841 1200.

No TFN or DOB on tax returns

To protect your personal information we no longer print your TFN (tax file number) or DOB (date of birth) on your tax returns.

Your TFN, coupled with your date of birth, is information that you don't want stolen so we are intentionally leaving this information off to protect your information from identity theft.

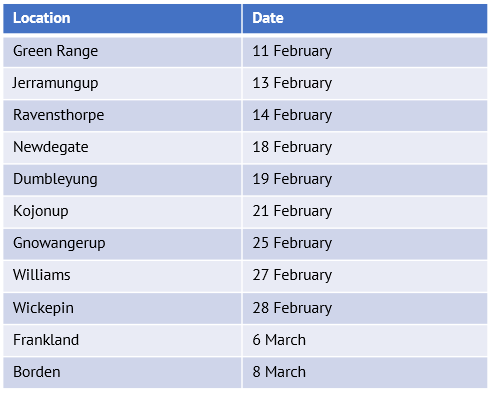

Lincolns rural tour

We will be on the road in February! Our Agriculture and Employment seminar will be travelling to the locations below.

Stay tuned for more details.